Eighth-graders gain a better idea of how to claim their futures

By Stuart Hedstrom

Staff Writer

DOVER-FOXCROFT — Grade 8 students at the SeDoMoCha Middle School had a taste of the real world by figuring out how to cover monthly bills and unexpected expenses on the salaries of their chosen professions as young adults in the Claim Your Future Fair on the morning of Feb. 12 in the cafeteria.

Observer photo/Stuart Hedstrom

Observer photo/Stuart Hedstrom

LIFE’S CHOICES — SeDoMoCha Middle School eighth-graders briefly got to live in adulthood in the Claim Your Future Fair on Feb. 12 as they had each a monthly income based on their chosen professions and the pupils then had to make decisions on what they needed vs. what they wanted in terms of housing, transportation and other expenses. One such expense was insurance, as the eighth-graders waited in line at the insurance table manned by English/Language Arts teacher Kassaundra Foster. The fair was based on the Finance Authority of Maine’s Claim Your Future program.

“We are starting to work with the transition to high school, and it’s about giving them some good information as they get ready for high school,” grade 8 social studies teacher Dyan McCarthy-Clark said in-between assisting participants at the fair. She said students have learned about the various possibilities for life after high school, “and how do you choose a career?” McCarthy-Clark said part of this knowledge includes learning “how to do budget,” “how to keep checks,” and “the differences between wants and needs.”

For the Claim Your Future Fair, McCarthy-Clark said the eighth-graders “choose a profession without knowing what the income was,” with this information being provided by the Finance Authority of Maine (FAME) through its Claim Your Future program. She said the pupils then had a monthly income and they needed to determine their various options for housing, cars, insurance and more while paying for other expenses such as student loan and credit card debt and putting money away.

McCarthy-Clark said Principal Julie Kimball secured free kits from FAME that provide students with information on planning for adulthood, which include circular charts with income and various expenses. “We siphoned off that to make something that is much more active,” McCarthy-Clark said. “It’s all online and they could blow through it and not understand it, but kids learn more and remember more when they are active learners.”

With their incomes in hand and equipped with clipboards and calculators, the eighth-graders were each given a “Claim Your Future Budget Sheet” and they needed to go around to over a half dozen tables for living expenses selections. “They make choices, hopefully wise choices,” McCarthy-Clark said.

For housing the students could choose to live with their parents, rent an apartment with a roommate or by themselves, rent a house or own their own home, with the monthly bills ranging from $275 to $1,375. The eighth-graders could choose how to get around, such as public transportation and various used and new cars which all varied in expense.

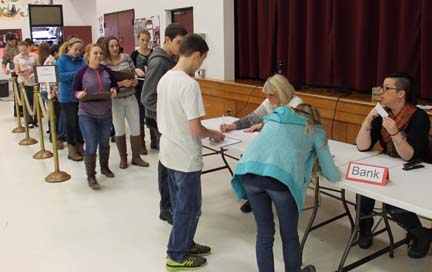

“For everything they do they have to bring a check to the bank,” McCarthy-Clark said, as a line formed at the bank table, manned by several staff members, for the students to have their various choices recorded so they could then make other financial decisions based on their remaining monies.

Another necessary future expense for the eighth-graders is insurance, as the students waited in line at the insurance table with English/Language Arts teacher Kassaundra Foster. The pupils had various options for the types of coverages they wanted for auto, homeowners and renters and medical, all with different prices for them to consider.

The eighth-graders also could choose from various extras — the wants in wants vs. needs — including having pets, going to the movies and other nights out and owning video game systems. For some, the option of taking on a second job was presented to provide additional income.

As the students moved around from table to table, Kimball handed out cards at random. Some cards were for unexpected incidents, such as a stolen identities, a break-in or a fire, which resulted in costs that the eighth-graders could not plan for. Other cards were unanticipated bonuses, such as winning a small sum of spending money on a lottery ticket.

McCarthy-Clark said some of the students were nervous at the start of the Claim Your Future Fair, but these feelings “are OKay because that’s why we are doing this.” She said some of the participants may have gained a bit of an understanding of what their parents go through with their household budget planning.

Observer photo/Stuart Hedstrom

Observer photo/Stuart Hedstrom

WAITING IN LINE AT THE BANK — For every financial decision made by SeDoMoCha Middle School eighth-graders during the Claim Your Future Fair on Feb. 12, the students needed to visit the bank table to have the choice cost deducted from their monthly incomes. The fair helped teach financial literacy to get the pupils thinking about life beyond high school as part of the transition program readying them to attend Foxcroft Academy next year.